State 'Green Banks' Helping Fund Clean-Energy Expansion (Op-Ed)

Hallie Kennan, a research assistant at Energy Innovation: Policy and Technology, contributed this article to LiveScience's Expert Voices: Op-Ed & Insights.

Public-private partnerships are not a new concept, especially in the energy sector. For decades, national labs have worked with private companies to create cutting-edge energy technologies, and government bonds and loan programs have provided financial support throughout the development process of these technologies. This dynamic relationship allowed such technologies to grow and become successfully-integrated components of the United States's energy infrastructure.

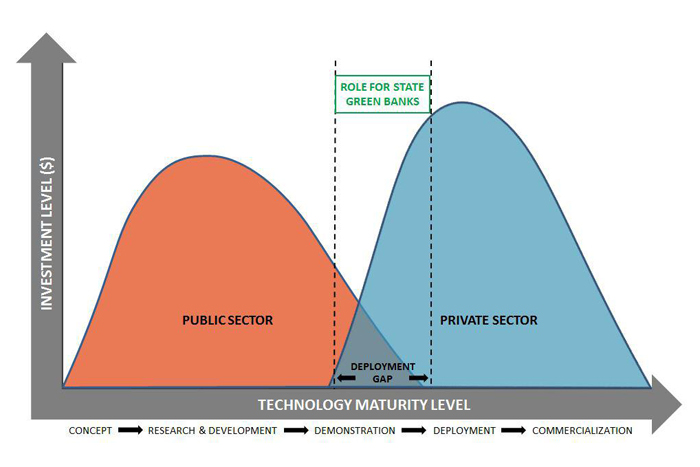

Clean energy and energy efficiency are the new kids on the block, and while not yet at the same level of full-market diffusion as the more established energy technologies, they are steadily making their way past early-stage development and into the broader marketplace. The government has traditionally helped nurture energy technologies in their infancies, accepting a great deal of risk involved in their innovation and development. As technologies exit the development stage, they have a need for capital to deploy their products on the broader general market, which has been a consistent challenge for young companies.

In recent years, policymakers have developed the concept of a clean-energy finance authority, a new type of public-private partnership that overcomes the barrier of expensive deployment by lowering the cost of investment in energy efficiency and clean-energy projects. These finance authorities, also known as 'green banks,' can capitalize on the unique resources and strengths from the government and the private sector to provide low-cost, low-risk investments that will help scale up the clean-energy economy.

While there is no single definition of a green bank, they are commonly known as a partially government-owned financial institution that offers safe and affordable investment opportunities for clean-energy projects. The concept of a green bank has proven to be most effective at the state level. Typically, state green banks are initially funded from government sources, which accept the initial investment risk, and thus, attract private sector for the remaining investment needs. Once clean-energy programs and projects have been successfully established, a key objective of state green banks is to ramp down government's financial role and allow the private sector to take over the majority of the investment opportunities.

There are several advantages to implementing a state green bank. First, they optimize public spending by lowering investment costs and increasing the amount of private financing for clean-energy projects. The private sector is often constrained by insufficient capital or time to support a clean-energy project. State green banks help address this gap since the government provides a portion of the initial capital and can afford to take on projects with longer payback horizons. Additionally, state green banks use financing tools that generate returns, allowing the bank to become self-sustaining and encouraging the private sector to continue investing. Lastly, by being established at the state level, green banks can more effectively address unique geographical and political conditions that exist in their jurisdictions. [Efficiency is the Energy of the Future, and the Present (Op-Ed )]

Many states recognize the benefits that green banks can offer, and several have recently established green banks. Vermont and Hawaii each passed congressional bills this year to create loan funds that support clean energy and energy efficiency programs. New York established the NY Green Bank last winter, and has already designated $165 million in uncommitted funds toward its initial capitalization. Other states like California, Maryland, and Illinois, are also at various stages of proposing and approving legislation for green banks.

Get the world’s most fascinating discoveries delivered straight to your inbox.

To date, the strongest model for state green banks is Connecticut's Clean Energy Finance and Investment Authority, or CEFIA. Established in 2011, CEFIA grew out of the Connecticut Clean Energy Fund and partnerships with other state agencies. CEFIA funding generally goes toward projects that use proven technologies and have existing opportunities for deployment, but are limited by capital and time constraints. Currently, the bank's private investment ratio is 4:1, meaning every $1 of the bank's funds has generated approximately $4 in private investment. Over the next two years, the bank aims to increase this ratio to 5:1 on average, with some structures being leveraged up to 9:1.

To be financially self-sustaining, CEFIA has focused on offering finance mechanisms that provide a payback for investors. These include tools such as direct lending and co-lending, on-bill financing, credit enhancements, and property-assessed clean energy (PACE) projects. Loans may come entirely from the state green bank (direct lending) or from a partnership with private investors (co-lending). On-bill financing is a type of low-risk loan that is repaid directly through a property's utility bill, which has proven to have lower rates of non-payment than other bills. Credit enhancement tools, like loan loss reserves and loan guarantees, help lower the cost of capital and reduce risk for private investors. Lastly, PACE programs provide loans for energy efficiency and retrofit projects that are repaid over time through a charge on the property's tax bills.

One of CEFIA's largest Commercial Property-Assessed Clean Energy (C-PACE) projects to date is the retrofit of a mixed-use building in downtown Bridgeport. The C-PACE program provided nearly $2 million in construction financing for energy efficiency measures such as new cooling towers, energy efficiency windows and new chillers. These installations save the building 1.4 million kWh every year, a 60-percent reduction in energy use. This translates into nearly $300,000 in electricity and fuel cost savings annually. C-PACE projects for other Connecticut buildings include financing for installs of LED lighting and solar PV panels.

Renewable energy sources and energy efficiency practices have proven to be increasingly viable alternatives to conventional energy consumption. However, high cost of deployment hinders investment in these cutting-edge technologies, limiting their future growth. State green banks help overcome the financial barriers these technologies face, thus pushing them into the market as cost-effective alternative energy options.

Kennan's most recent Op-Ed was "HFCs? Curbing Them Is Key to Climate-Change Strategy." The views expressed are those of the author and do not necessarily reflect the views of the publisher. This version of the article was originally published on LiveScience.