Google Searches Could Predict the Next Financial Crisis

Predicting the rises and falls of the stock market may have become a whole lot easier: A new study suggests that publicly available data from Google Trends, a tool that tracks terms people plug into the search engine, can be used to forecast changes in stock prices.

The study found that Google users tend to increase their searches for certain keywords in the weeks proceeding a fall in the stock market.

Researchers at Boston University and the University of Warwick, in the United Kingdom, grouped the popularly searched keywords on Google into topics. They then used Google Trends to compare the search volume for these topics between 2004 and 2012 to fluctuations in the Standard & Poor's 500 Index (S&P 500), the stock market index for the 500 largest U.S.-based companies. [Top 10 Inventions that Changed the World]

They found that, historically, Google users search more for topics related to business and politics in the weeks preceding a fall in the stock market. Searches related to other topics, such as music or weather, weren't found to have any significant connection to changes in stock prices.

Previously, the researchers had looked at how the volume of Google searches for finance-related terms — "debt" or "bank," for instance — might be related to fluctuations in the stock market. They found that an increase in the volume of these types of searches could be used to predict a fall in stock prices.

In their new study, the researchers took a broader look at what people might be searching forin the weeks before a downward turn in the market. The researchers analyzed 100 topics, to see which ones correlated with changes in stock prices. They found that only business and political topics had any significant correlation to the market.

"Increases in searches relating to both politics and business could be a sign of concern about the state of the economy, which may lead to decreased confidence in the value of stocks, resulting in transactions at lower prices," said Suzie Moat, an assistant professor of behavioral science at Warwick Business School and co-author of the study.

Sign up for the Live Science daily newsletter now

Get the world’s most fascinating discoveries delivered straight to your inbox.

Financial crises, such as the one that affected markets worldwide in 2007 and 2008, can arise in part from the interplay of decisions made by many individuals. But to understand this interplay, or "collective decision-making," it's helpful for researchers to first examine the information that drives decision-making.

This is why Google Trends is such an important tool, the researchers said.

"The data we gather from Google gives us unprecedented insight into information large numbers of people are gathering," Moat told Live Science in an email. "Our study provides evidence that this information-gathering data can help us develop forecasts of actions people subsequently take in the real world."

But Moat and her fellow researchers aren't just interested in how Google searches are related to movements in the stock market. They're also excited about the prospect of using Google Trends to predict other events in the real world.

"We are interested in financial markets, but also in domain areas far beyond this, such as human reactions to natural disasters, protests, crime, elections and disease spreading," said Chester Curme, a graduate student in the department of physics at Boston University who contributed to the study. 'We believe data on information gathering and dissemination may help us understand subsequent real-world actions in all of these areas."

And Google isn't the only site the researchers will be mining for future studies. Curme said his team is also looking at the information that people gather from sites like Wikipedia, Twitter and Flickr, to name a few.

The new study was published July 28 in the journal Proceedings of the National Academy of Sciences.

Follow Elizabeth Palermo on Twitter @techEpalermo, Facebook or Google+. Follow Live Science @livescience. We're also on Facebook & Google+. Original article on Live Science.

Elizabeth is a former Live Science associate editor and current director of audience development at the Chamber of Commerce. She graduated with a bachelor of arts degree from George Washington University. Elizabeth has traveled throughout the Americas, studying political systems and indigenous cultures and teaching English to students of all ages.

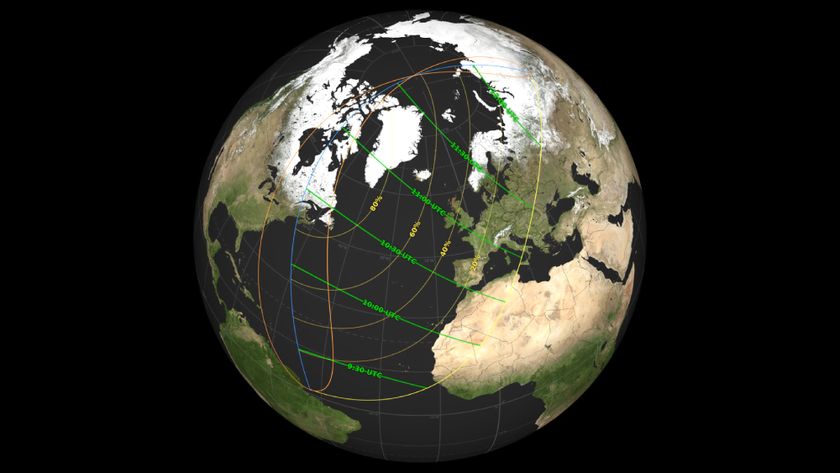

Staring at the March 29 solar eclipse can cause eye damage in seconds — and you won’t even feel it happening

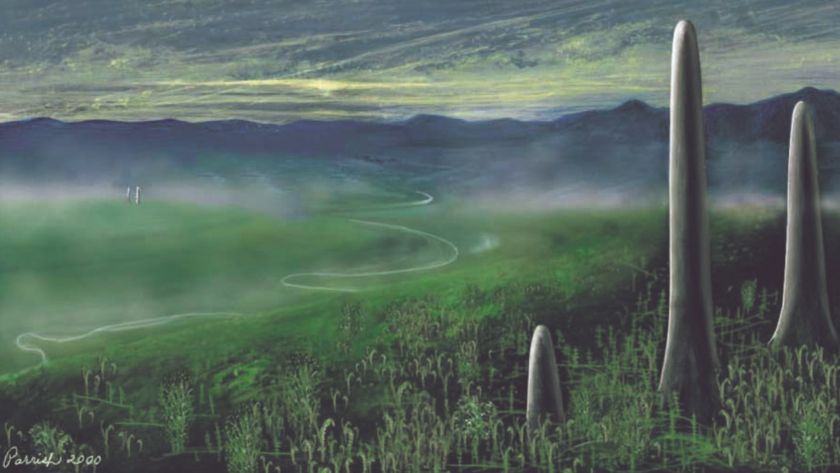

'Woolly devil' flowers in Texas desert are the 1st new plant genus discovered in a US national park in almost 50 years

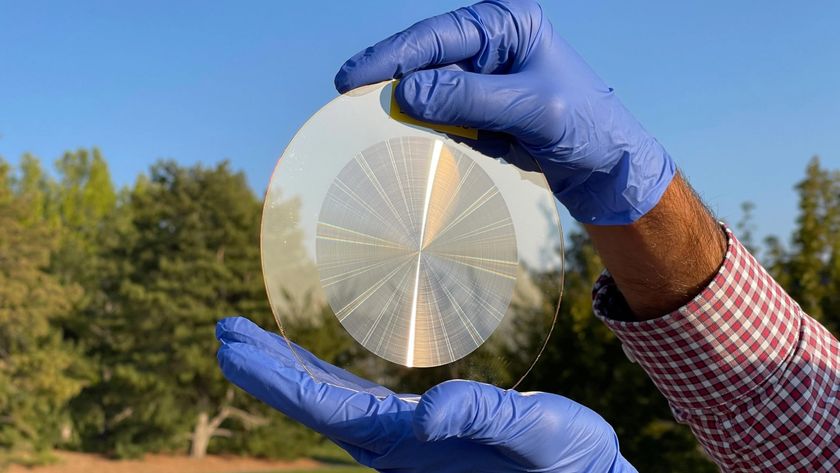

Flat, razor-thin telescope lens could change the game in deep space imaging — and production could start soon