Apes Make Irrational Economic Decisions — That Includes You

This article was originally published on The Conversation. The publication contributed this article to Live Science's Expert Voices: Op-Ed & Insights.

Just the other day I found myself in the waiting room of an automotive dealership. While my car was being serviced, I flipped through a product brochure. One ad for an oil change boasted that it would clean out at least 90% of used oil. Another for new brakes guaranteed maximum performance for twelve months. No one was advertising oil changes that leave behind 10% sludge, or brakes that begin to fail after only a year.

That’s because advertisers know that people are sensitive to how options are framed. We appraise goods more highly when their positive attributes are emphasized over their negative attributes, even if the details describe essentially the same situation (e.g., 90% clean versus 10% dirty).

This is called attribute framing, and it’s just one example of many irrational biases that humans exhibit when making economic decisions. Other examples include loss aversion (the preference for avoiding losses over acquiring gains), the endowment effect (people ascribe more value to something once they own it), and the reflection effect (people shift their risk preferences when dealing with gains versus losses).

These irrational biases are common, they’re really hard to overcome, and they have pervasive impacts on human market behavior. For example, people are more likely to spend a sum of money when it is framed as a bonus than when it is framed as compensation for a previous loss, like a rebate, which has implications for population trends in spending versus saving. Framing also influences people’s medical decisions, such as their tendency to undertake preventative measures in personal health care. And it’s often leveraged by marketing agencies to improve sales.

Decision-making research can help economic institutions – built on the erroneous assumption that people will behave rationally – to account for predictable irrationality. It can also help us to design choice environments that lead people to make decisions that are better for them. For these reasons, Daniel Kahneman was awarded the Nobel Prize in Economics in 2002, for his contributions (with the late Amos Tversky) to the understanding of irrational decision-making.

Irrational… but why?

Recent research attempts to understand where these biases come from. In most societies, humans interact with monetary markets from a young age; it seems intuitive that such exposure would be the principle source of decision-making strategies and biases. Culture and socialization must be involved, right?

Sign up for the Live Science daily newsletter now

Get the world’s most fascinating discoveries delivered straight to your inbox.

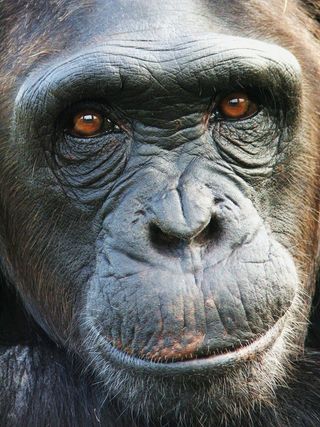

But while human culture and market experience may play a role, it now seems clear that choice biases are much more deeply rooted in our biology. Previous investigations had shown that some other species – including European starlings and capuchin monkeys – may also exhibit irrational biases such as framing effects. However, because these species are fairly distant relatives of humans, it is difficult to know if framing effects are shared as a result of common ancestry, or if they evolved independently in each species. To address this question, my colleagues, Alexandra Rosati and Brian Hare, and I investigated attribute framing in human beings’ closest living relatives, bonobos and chimpanzees.

We tested 23 chimpanzees at Tchimpounga Chimpanzee Sanctuary in the Republic of Congo and 17 bonobos at Lola ya Bonobo sanctuary in the Democratic Republic of Congo. In the study, we presented the apes with choices between several peanuts and some fruit. In the positive “gain” condition, we framed the fruit option positively. We initially presented it as a single piece of fruit, but, half the time that the apes chose it, we provided them with a second piece as well. The negative “loss” condition was identical, except that in this condition we framed the fruit option negatively. Here we presented the fruit option as two pieces of fruit, but, half the time the apes chose it, we took a piece back and only provided the ape with one.

Even though in both conditions apes who chose the fruit option received identical payoffs — a 50-50 chance of getting one or two pieces of fruit — they chose the fruit option significantly more when it was framed positively than when it was framed negatively: apes, too, make irrational economic decisions.

Irrational apes

Because bonobos, chimpanzees, and humans all exhibit framing effects, it is unlikely that this trait evolved independently in each lineage. Instead, it appears that choice biases are evolutionarily ancient. They were probably present in the last common ancestor of bonobos, chimpanzees, and humans, which lived about six million years ago, and may even be much older. That framing effects are shared with several non-human species also suggests that these biases are deeply rooted in our biology, and can arise in the absence of experience with uniquely human monetary markets. Choice biases may have evolved in response to certain challenges in foraging ecology, or they may represent a by-product for selection on other traits, such as emotions.

Interestingly, we found that male apes were much more susceptible to framing than female apes were. In humans, gender differences in decision-making may result from a number of different factors, including gender-specific socialization, motivational differences, or experience with markets. Our results underscore the importance of studying large populations of non-human animals: since animals lack many uniquely human characteristics such as gender norms, animal studies can address more basic hypotheses about the origins of individual differences in human decision-making.

Our findings contribute to a large body of research on human decision-making that tells a pretty consistent story: choice biases are deeply ingrained, and they’re often really hard to overcome. Even the well-informed psychologist may find him- or herself getting duped by marketing sway on a daily basis – at the mall, the grocery store, the local coffee shop. While decision research can facilitate more effective marketing strategies, it can also be used by health professionals, banks, architects, and urban planners to build better environments, environments that make people happier and help them to make better decisions.

This article was originally published on The Conversation. Read the original article. Follow all of the Expert Voices issues and debates — and become part of the discussion — on Facebook, Twitter and Google +. The views expressed are those of the author and do not necessarily reflect the views of the publisher. This version of the article was originally published on Live Science.